Unlocking Affordable Car Insurance In Utah: A Young Driver's Guide

As a young driver in the Beehive State, the prospect of finding cheap car insurance can feel like a daunting challenge. The harsh reality is that insurance companies often view us as high-risk, leading to sky-high premiums that can put a significant strain on our budgets. But fear not! In this comprehensive guide, I'll share practical strategies and insider tips to help you navigate the insurance landscape and secure the most affordable coverage options in Utah.

Understanding the Challenges: Why Cheapest Car Insurance Utah is Hard to Find for Young Drivers

Let's start by addressing the root cause of the problem -- why are car insurance rates so high for young drivers like us? The primary reason lies in the statistics: drivers between the ages of 16 and 19 are significantly more likely to be involved in accidents compared to their older counterparts. This increased risk factor is a major concern for insurance providers, who in turn charge higher premiums to offset the potential liability.

Moreover, research has shown that young drivers are more prone to engaging in risky behaviors behind the wheel, such as speeding and distracted driving. These habits can contribute to a higher accident rate, further justifying the insurance industry's caution when it comes to insuring us.

I've witnessed firsthand the impact a single at-fault accident can have on insurance costs. A young driver I know experienced a staggering 50% spike in their premiums after a minor incident. This underscores the importance of not only finding the cheapest car insurance but also maintaining a clean driving record.

Uncovering the Most Affordable Options in Utah

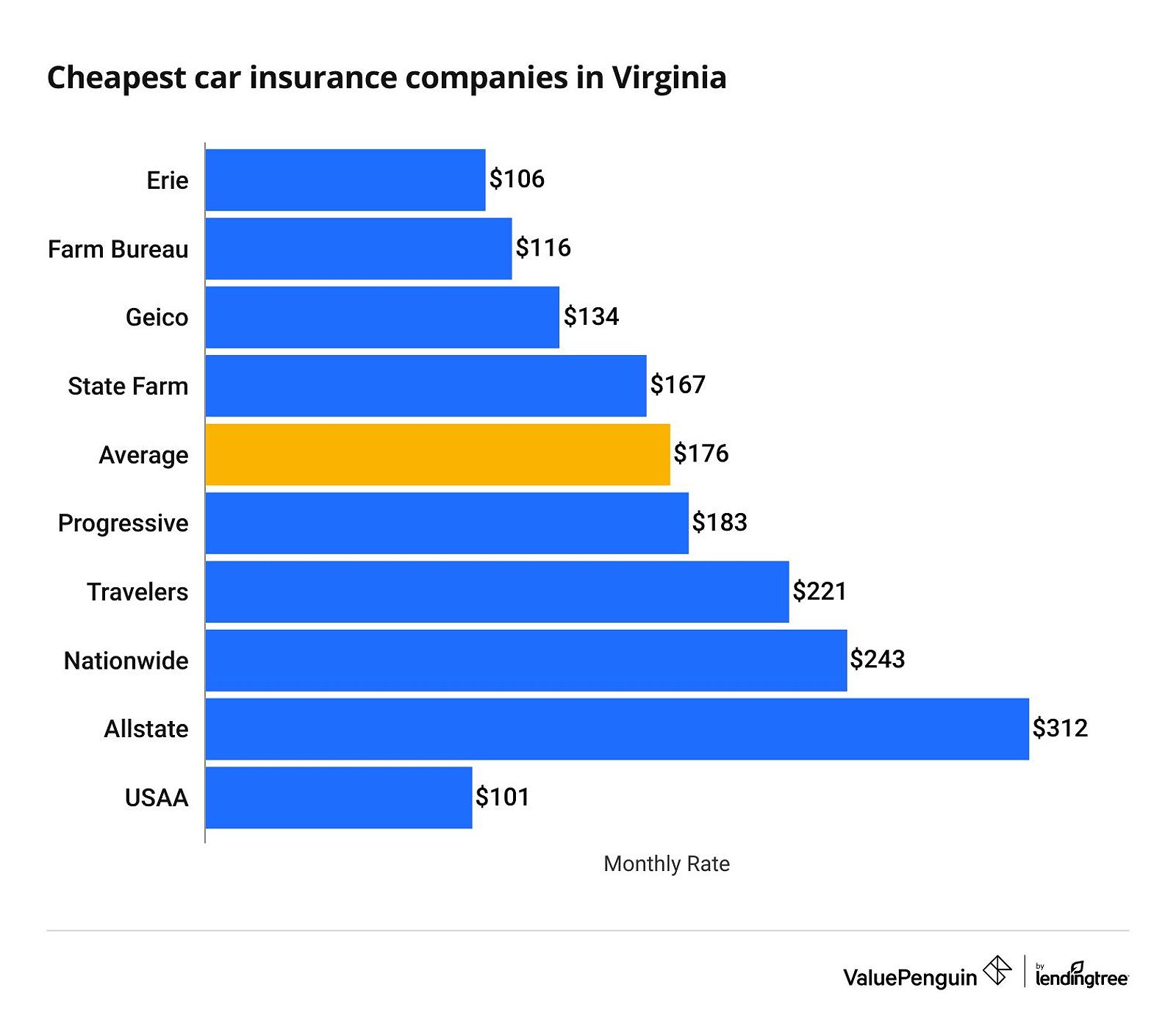

Now, let's dive into the nitty-gritty and explore the insurance companies offering the most competitive rates for young drivers in Utah. Based on my research, here are some of the top contenders:

Minimum Coverage Options

For those seeking the bare minimum to comply with state requirements, consider these providers:

- Farmers Union Insurance: $396 per year

- Nationwide: $433 per year

- Progressive: $495 per year

While minimum coverage may seem like the most budget-friendly choice, it's crucial to weigh the pros and cons. This basic level of protection will cover liability for bodily injury and property damage, but won't provide any coverage for damage to your own vehicle. In the event of an accident, you could be left with significant out-of-pocket expenses.

Comprehensive Coverage Options

If you're looking for more robust protection, these companies offer some of the cheapest full coverage options:

- Nationwide: $725 per year

- Farmers Union Insurance: $860 per year

- Auto-Owners Insurance: $922 per year

Full coverage, which includes liability, collision, and comprehensive protection, may be the wiser investment, especially if you're driving a newer or more valuable vehicle. The added peace of mind can be worth the slightly higher cost.

| Coverage Type | Farmers Union Insurance | Nationwide | Auto-Owners Insurance |

|---|---|---|---|

| Minimum Coverage | $396 | $433 | $495 |

| Full Coverage | $860 | $725 | $922 |

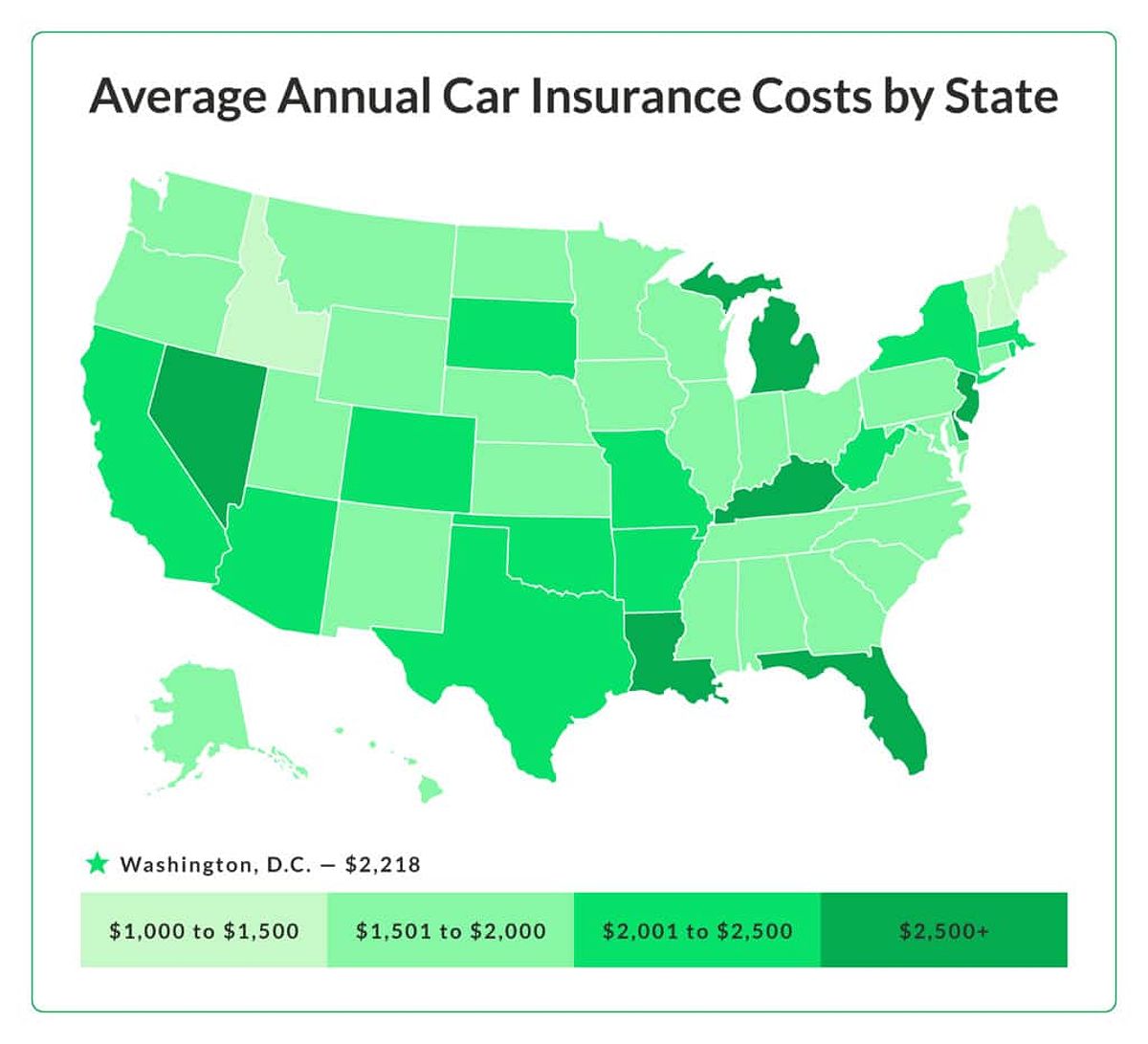

Remember, these figures are just a starting point. Your actual rates may vary depending on factors like your driving history, location, and the type of car you drive. It's always best to shop around and compare quotes from multiple insurers to find the most suitable and affordable option.

Strategies to Slash Your Car Insurance Costs

Even after finding the cheapest car insurance company, there are several additional tactics you can employ to further reduce your premiums. Let's explore some of the most effective strategies:

Capitalize on Available Discounts

Insurance providers often offer a variety of discounts that can significantly lower your costs. Keep an eye out for these common money-saving opportunities:

- Good Student Discount: Maintain a solid academic record (typically a B average or higher) and you could qualify for a discount.

- Defensive Driving Course Discount: Complete an approved defensive driving course to demonstrate your commitment to safe driving practices.

- Multi-Car Discount: If you share a policy with your parents or have multiple vehicles insured, you may be eligible for a bundle discount.

- Safe Driver Discount: Maintain a clean driving record, and insurers will reward you with lower rates.

- Pay-in-Full Discount: Consider paying your annual premium upfront to potentially save on monthly installment fees.

Select the Right Level of Coverage

Choosing the appropriate coverage level is essential for striking a balance between cost and protection. For instance, if you drive an older, less valuable vehicle, you may opt for liability-only coverage to save on your monthly premiums. Conversely, if you have a newer, more expensive car, full coverage may be the wiser investment to safeguard your investment.

Review your policy regularly and adjust your coverage as your circumstances change, such as moving to a different city or getting a new job. This proactive approach can help you keep your insurance costs in check.

Prioritize a Clean Driving Record

Your driving history is a crucial factor in determining your insurance rates. Maintaining a spotless record, free of speeding tickets, accidents, and other infractions, is essential for securing the cheapest car insurance in Utah. Insurance companies typically evaluate your driving history over the past three to five years, so it's crucial to exercise caution and responsible driving habits.

If you do receive a ticket or get involved in an accident, address the situation promptly and responsibly. Consider taking a defensive driving course, as this can sometimes help mitigate the impact on your insurance premiums.

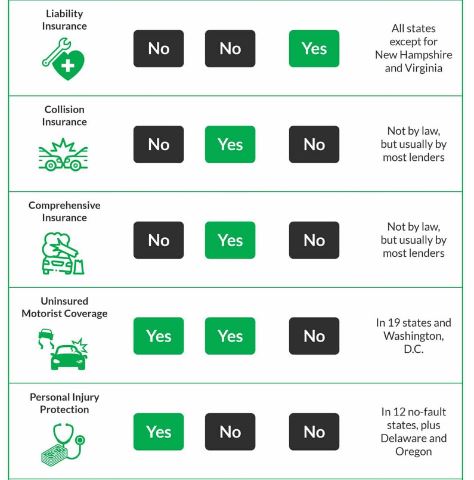

Understanding Utah's Car Insurance Requirements

As young drivers in Utah, it's essential to familiarize ourselves with the state's minimum car insurance requirements. This includes:

- Bodily Injury Liability: $25,000 per person and $65,000 per accident.

- Property Damage Liability: $15,000 per accident.

- Personal Injury Protection (PIP): $3,000 per person.

Failing to meet these minimum coverage levels can result in legal penalties, such as fines and the potential suspension of your driving privileges. While these requirements are the bare minimum, it's often wise to consider additional coverage options to ensure comprehensive protection in the event of an accident.

FQAs

Can I get car insurance without my parents?

Yes, young drivers can obtain their own car insurance policies. However, you may find it more cost-effective to be added to your parents' policy, as this can often lead to lower premiums due to the shared risk.

What happens if I get a ticket or have an accident?

Getting a ticket or being involved in an accident can have a significant impact on your insurance rates. Insurance companies view a history of infractions as an indicator of higher risk, which can result in substantial increases to your premiums. Maintaining a clean driving record is essential for securing the cheapest car insurance in Utah.

How do I compare car insurance quotes?

To compare quotes effectively, visit multiple insurance company websites or use comparison tools that allow you to see various options side by side. It's recommended to gather quotes from at least three different providers to ensure you're getting the best deal.

What is the difference between minimum and full coverage?

Minimum coverage meets the state's legal requirements and provides basic protection, while full coverage offers more comprehensive protection, including coverage for damages to your own vehicle. Young drivers should carefully assess their needs and budget to determine the appropriate level of coverage.

Can I get a discount if I'm a good student?

Yes, many insurers offer discounts for students who maintain a certain GPA, typically a B average or higher. This can be a significant money-saving opportunity, so be sure to inquire about this option when shopping for insurance.

Conclusion

As a young driver in Utah, navigating the car insurance landscape can be a daunting task, but it doesn't have to be. By understanding the factors that contribute to high premiums, exploring the cheapest insurance options, and leveraging various cost-saving strategies, you can secure the coverage you need without breaking the bank.

Remember, the key to finding the most affordable car insurance is to shop around, take advantage of available discounts, and maintain a clean driving record. With a little diligence and the right approach, you can confidently hit the road while keeping your insurance costs in check.

If you're ready to start your search for the cheapest car insurance in Utah, I recommend using a reliable comparison tool to gather quotes from multiple providers. This will give you a clear understanding of your options and empower you to make an informed decision that aligns with your budget and coverage needs. With the right strategy, you can unlock significant savings and enjoy the freedom of the open road without the burden of high insurance costs.