Strategies For Finding Affordable Car Insurance Quotes In Maryland As A Young Driver

Navigating the world of car insurance quotes in Maryland as a young driver can be a challenging experience. Statistics show that younger drivers often face higher premiums compared to more experienced motorists. This makes finding the right balance between adequate coverage and affordable costs a priority. By understanding Maryland's insurance requirements and taking the right approach, you can secure the best car insurance quotes tailored to your needs.

Decoding Maryland's Car Insurance Essentials for Young Drivers

In the Old Line State, all drivers, regardless of age, are required to carry a minimum level of liability insurance. This is often referred to as a "30/60/15" policy, meaning you must have at least $30,000 in bodily injury liability coverage per person, $60,000 per accident, and $15,000 in property damage liability coverage. These minimum requirements are designed to ensure that you have the necessary financial safeguards in place to cover the damages and medical expenses of others involved in an accident.

The Importance of Liability Coverage

For young drivers, understanding these liability limits is essential. They serve as a crucial financial safety net, protecting you from being personally liable for excessive damages in the event of an accident. However, relying solely on the minimum coverage may not provide adequate protection, especially if you cause a serious collision. Therefore, considering higher liability limits is a wise choice to ensure you are properly covered.

Uninsured and Underinsured Motorist Coverage: Safeguarding Your Finances

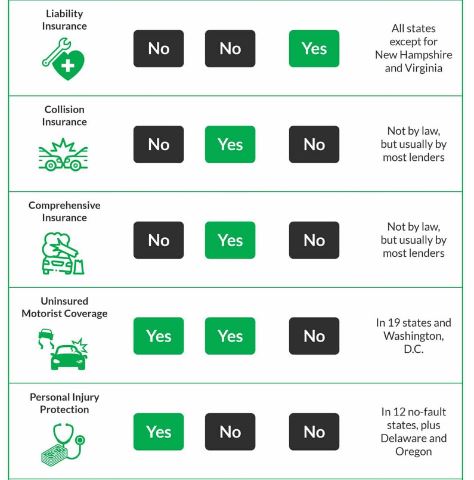

In addition to liability coverage, Maryland drivers must have uninsured and underinsured motorist coverage with the same limits as their liability coverage. This type of insurance is particularly important for young drivers, who may be more likely to encounter uninsured or underinsured drivers on the roads. In the unfortunate event of an accident with someone who lacks adequate insurance, this coverage will help shield you from significant financial loss.

Navigating the Optional: Personal Injury Protection (PIP)

Another crucial aspect of Maryland's car insurance landscape is Personal Injury Protection (PIP). While not mandatory, insurers must offer PIP, and you have the option to waive it. PIP covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident. For young drivers, who may be more vulnerable to accidents, opting for PIP can provide peace of mind and financial support in the event of injuries.

Exploring Additional Coverage Options

Beyond the mandatory coverages, young drivers should also consider additional options such as collision and comprehensive insurance. Collision insurance helps cover the cost of repairs to your vehicle after an accident, while comprehensive insurance protects against damages from non-collision events, such as theft, vandalism, or natural disasters. Although these coverages increase your premium, they can save you from significant out-of-pocket expenses if something happens to your vehicle.

Finding the Most Affordable Car Insurance Quotes in Maryland for Young Drivers

Several factors can significantly impact the car insurance rates you receive in Maryland, including your age, driving history, vehicle type, and location. As a young driver, you'll likely pay more for coverage compared to older, more experienced motorists. Insurers consider young drivers as higher risk due to their limited driving experience and tendency to engage in riskier behavior.

Understanding the Key Factors Influencing Your Rates

- Age: Younger drivers, particularly those under 25, typically face higher premiums due to their inexperience.

- Driving Record: A clean driving record can significantly lower your rates, while traffic violations or accidents can lead to increases.

- Vehicle Type: The make and model of your car can influence your rates. Sports cars and luxury vehicles often come with higher premiums, while safer, older models may cost less to insure.

- Location: Where you live plays a crucial role in determining your rates. Urban areas with higher traffic and accident rates generally have higher insurance costs compared to rural areas.

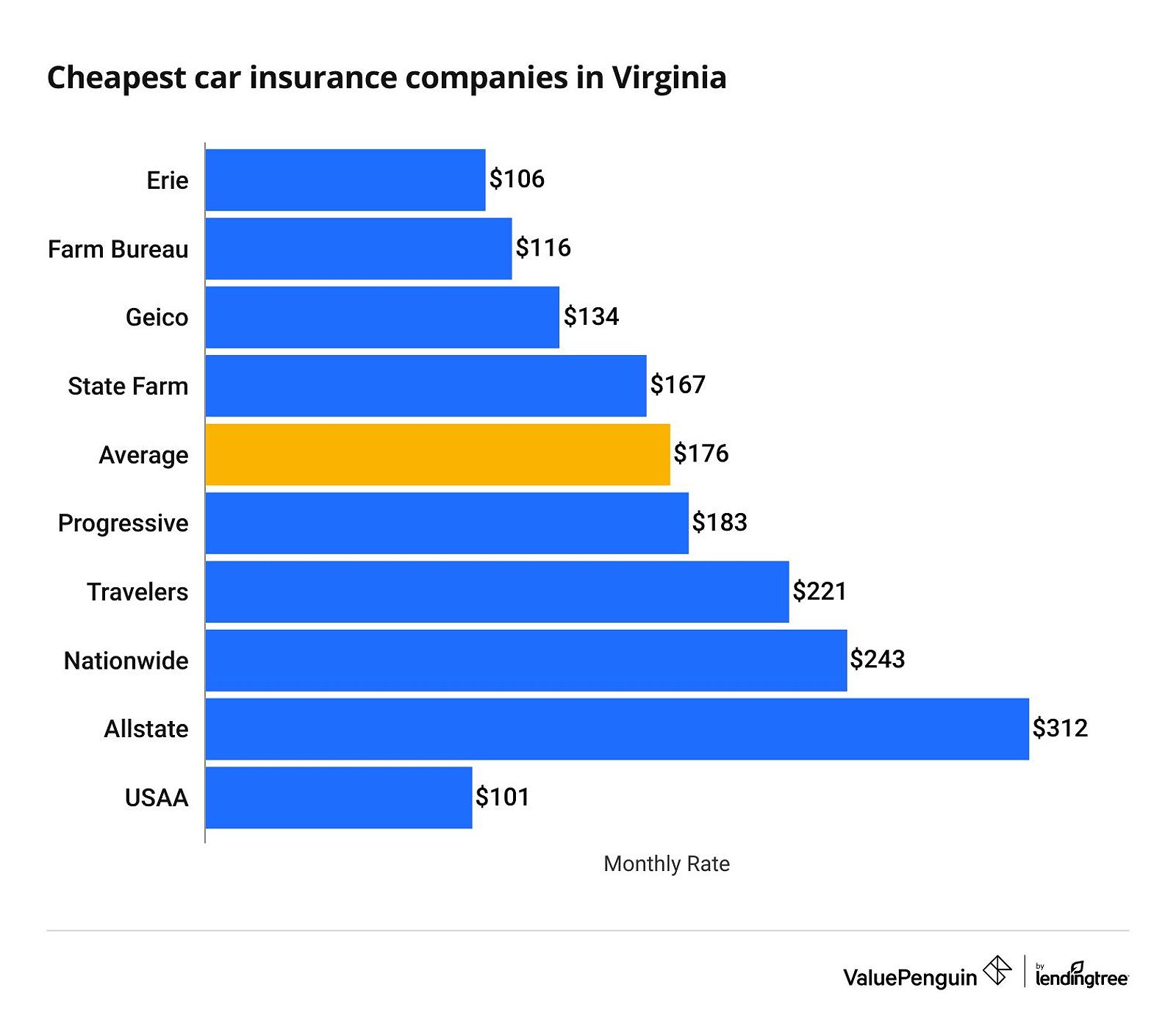

To find the most affordable car insurance quotes in Maryland, it's essential to compare rates from multiple companies. Start by obtaining quotes from several reputable insurers, focusing on those known for competitive rates for young drivers. Some of the top contenders in the state include Geico, State Farm, and Erie Insurance. Geico is often praised for offering the cheapest minimum-coverage policies, while State Farm and Erie tend to have more affordable full-coverage options.

Maximizing Savings with Available Discounts

In addition to comparing rates, be sure to take advantage of any available discounts. Young drivers in Maryland may qualify for savings such as:

- Good Student Discount: Maintain a strong academic performance, typically a B average or higher, to earn a discount on your premiums.

- Defensive Driving Course Discount: Complete an approved defensive driving course to demonstrate your commitment to safe driving and potentially qualify for a discount.

- Multi-Car or Multi-Policy Discount: Bundle your car insurance with other policies, like homeowners or renters insurance, to save money.

- Usage-Based or Telematics Discount: Some insurers offer discounts for drivers who use devices that track their driving habits and demonstrate safe behavior.

By combining the most competitive quotes with available discounts, you can significantly reduce the cost of car insurance as a young driver in Maryland.

Strategies for Young Drivers in Maryland to Save on Car Insurance

Beyond finding the cheapest quotes and taking advantage of discounts, there are additional tactics young drivers can employ to save on car insurance in Maryland:

Maintain a Clean Driving Record

Avoiding traffic violations, accidents, and other infractions is crucial for keeping your car insurance rates low. Even a single speeding ticket or at-fault accident can cause your premiums to spike, so practice safe driving habits and be mindful of the rules of the road. In Maryland, maintaining a clean driving record can lead to substantial savings over time, as insurers reward safe drivers with lower rates.

Opt for a Used Vehicle

Choosing a used vehicle over a brand-new model can help you save on car insurance. Older, less expensive cars generally cost less to insure, as they have lower repair and replacement costs. Additionally, many used cars are equipped with safety features that can further reduce your premiums. When shopping for a vehicle, consider factors like safety ratings and repair costs to find the best option for your budget.

Enroll in Defensive Driving Courses

Completing an approved defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts from your insurance provider. These courses not only teach valuable driving skills but also help you become a more responsible driver. Many insurance companies offer discounts to drivers who complete these courses, making it a win-win situation.

Explore Flexible Payment Options

Some insurers offer discounts for paying your annual premium in full, rather than opting for monthly installments. Weigh the pros and cons of each payment plan to determine the best option for your budget. Additionally, some companies may provide flexible payment plans that can help you manage your expenses more effectively.

Utilize Online Comparison Tools

In today's digital age, there are numerous online tools available to help you compare car insurance quotes quickly and easily. Take advantage of these resources to gather multiple quotes, assess coverage options, and find the best rates for your specific situation. Comparing quotes online can save you time and money, allowing you to make an informed decision.

Regularly Review Your Policy

As your circumstances change, so should your car insurance policy. Periodically reviewing your coverage can help you identify opportunities for savings. For example, if you've maintained a clean driving record for several years, you may be eligible for lower rates. Additionally, if you've paid off your car or it has depreciated in value, adjusting your coverage can lead to further savings.

FAQ

Q: How much does car insurance cost for a 16-year-old in Maryland?

A: The average cost of car insurance for a 16-year-old driver in Maryland can be significantly higher than for older drivers. In 2024, you can expect to pay around $589 per month or $7,065 per year for a minimum-coverage policy.

Q: What are some common discounts available to young drivers in Maryland?

A: Young drivers in Maryland may qualify for various discounts, including good student discounts, defensive driving course discounts, multi-car discounts, and usage-based insurance discounts. Taking advantage of these savings opportunities can help offset the higher premiums typically associated with your age.

Q: Can I get car insurance if I have a speeding ticket?

A: Yes, you can still obtain car insurance even if you have a speeding ticket on your record, but your rates will likely be higher. The increase can vary, but on average, car insurance costs in Maryland go up by around 20% after a single speeding violation.

Q: What should I do if I get into an accident?

A: If you're involved in an accident, it's important to stay calm, exchange insurance information with the other driver, and contact your insurance company as soon as possible to file a claim. Documenting the incident with photos and a police report can also help streamline the claims process.

Conclusion

As a young driver in Maryland, navigating the car insurance landscape may seem daunting, but with the right strategies and a keen understanding of your options, you can secure affordable coverage that meets your needs. By familiarizing yourself with the state's insurance requirements, comparing quotes from multiple insurers, and taking advantage of available discounts, you can find the perfect balance between protection and cost savings. Remember, maintaining a clean driving record and exploring additional coverage options like collision and comprehensive insurance can further enhance your protection on the roads. With the right approach, you can confidently take on the challenges of getting car insurance as a young driver in Maryland.