Navigating Car Insurance Quotes In Pennsylvania As A Young Driver

Navigating the world of car insurance quotes in Pennsylvania can be a challenge, especially for young drivers. With so many coverage options, state requirements, and potential discounts, it's easy to feel lost. This guide will help you understand the key factors that impact your car insurance rates, provide strategies for getting the best quotes, and highlight discounts you may qualify for. By the end, you'll be confident in your ability to find the perfect insurance plan that meets your needs and budget.

Understanding Pennsylvania's Car Insurance Essentials

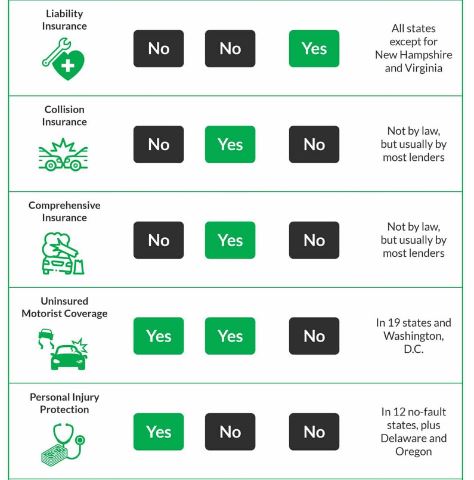

Before we dive into the nitty-gritty of finding the best car insurance quotes, it's crucial to understand the basic requirements in the Keystone State. In Pennsylvania, all drivers must maintain specific coverage types to stay compliant with the law. Let's break down the key components:

Liability Coverage: Your Financial Safety Net

The state mandates that you carry liability insurance, which includes protection for bodily injury and property damage. The minimum limits are $15,000 per person, $30,000 per accident for bodily injury, and $5,000 for property damage. This coverage ensures that if you're at fault in an accident, you can cover the costs associated with injuries to others and damage to their vehicle.

Medical Payments (PIP): Protecting You and Your Passengers

Personal Injury Protection (PIP), also known as medical payments coverage, is another essential element of Pennsylvania car insurance. This coverage pays for medical expenses for you and your passengers, regardless of who is responsible for the accident. The state requires a minimum of $5,000 in PIP coverage, but you may want to consider higher limits to ensure comprehensive protection.

Uninsured/Underinsured Motorist Coverage: A Critical Safety Net

As a young driver, you may encounter uninsured or underinsured motorists more frequently than your more experienced counterparts. This coverage steps in to protect you in the event of an accident with someone who lacks sufficient insurance. While it may not be legally required, this type of coverage can be a lifesaver if the unexpected happens.

By understanding these core insurance requirements, you can lay the foundation for finding the right coverage that meets Pennsylvania's standards and provides the protection you need.

Factors That Influence Car Insurance Quotes for Young Drivers

Now that you know the basics, let's dive into the factors that can impact your car insurance rates as a young driver in Pennsylvania. Knowing these elements can help you make informed decisions and potentially lower your premiums.

Age and Experience Matter

One of the most significant factors affecting your insurance rates is your age. As a young driver, typically under 25, you're often subject to higher premiums due to your relative lack of driving experience. Insurance companies view younger drivers as statistically more likely to be involved in accidents, which translates to higher risk and, consequently, higher rates.

Maintain a Clean Driving Record

Your driving history plays a crucial role in determining your car insurance costs. Traffic violations, accidents, or previous insurance claims can significantly increase your premiums. By consistently practicing safe driving habits, you can maintain a clean record and qualify for better rates over time.

The Vehicle You Choose Matters

The type of vehicle you drive can also impact your insurance costs. Generally, newer and more expensive cars will be more expensive to insure due to higher repair and replacement expenses. On the other hand, vehicles with strong safety ratings and low theft rates may qualify for lower premiums.

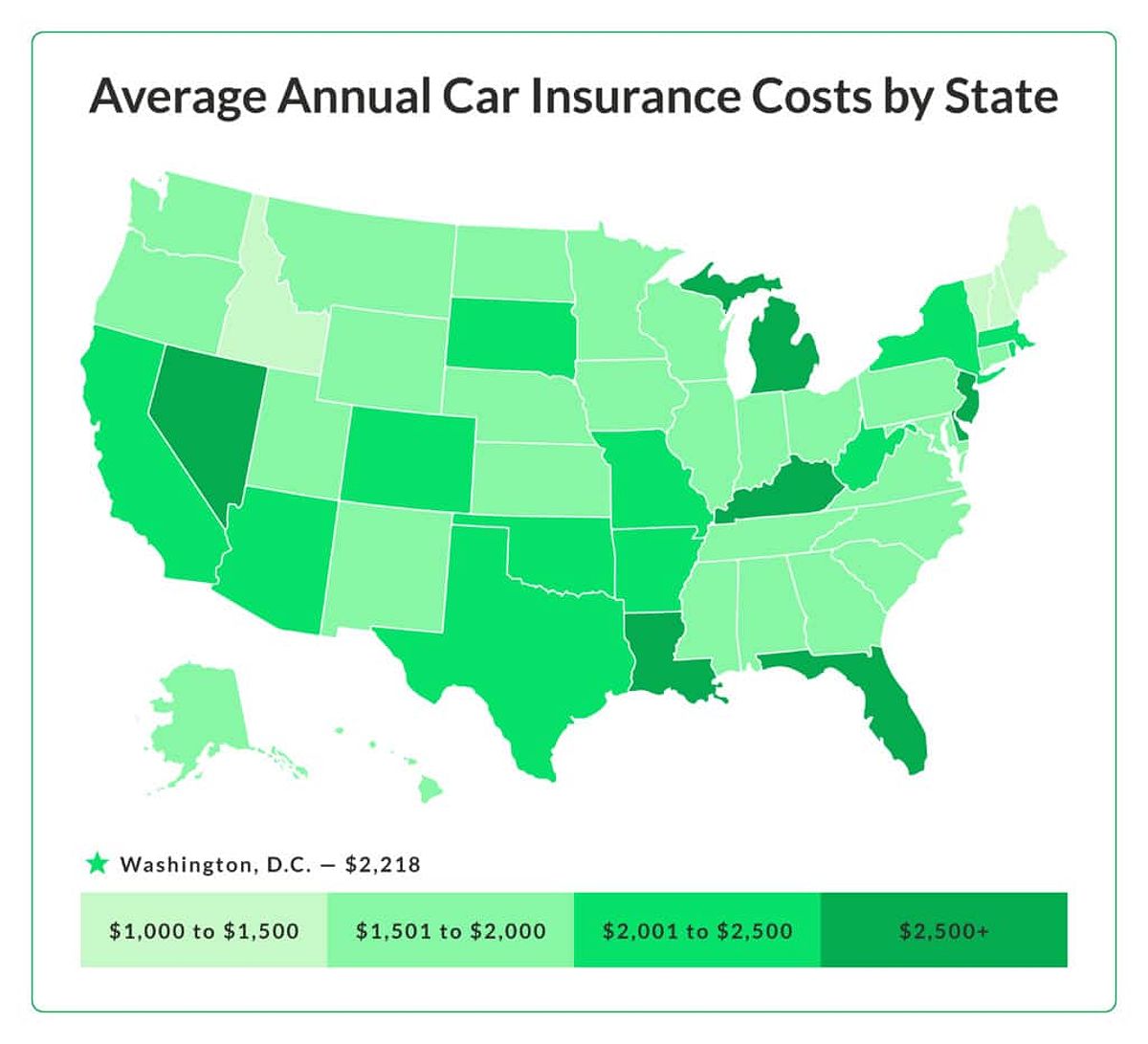

Where You Live Counts

The location where you reside in Pennsylvania can also influence your insurance rates. Urban areas with higher population density and crime rates typically see higher costs, while rural areas may offer lower rates due to fewer accidents and reduced theft risks.

Credit Score: A Hidden Factor

In Pennsylvania, insurance providers can use your credit score as a factor in determining your rates. Maintaining a good credit score can lead to more affordable premiums, while a poor credit score may result in higher costs. As a young driver, it's essential to prioritize building and maintaining a strong credit history.

By understanding these key factors, you can take proactive steps to position yourself for the best possible car insurance quotes in Pennsylvania.

Finding the Right Car Insurance Quotes in Pennsylvania

Now that you're familiar with the essential components of car insurance in Pennsylvania and the factors that affect your rates, let's explore strategies to help you find the most affordable and comprehensive coverage.

Leverage Online Comparison Tools

One of the most efficient ways to gather car insurance quotes is by utilizing online comparison platforms. These user-friendly tools allow you to input your information and receive multiple quotes from various insurers, making it easier to compare rates, coverage options, and customer reviews. Take advantage of these resources to streamline your search.

Work with Insurance Agents

When it comes to finding the best car insurance in Pennsylvania, you have the option to work with either direct insurers or independent agents. While direct providers offer quotes directly to consumers, independent agents can provide insights and options from multiple companies. Engaging with an experienced agent can help you navigate the nuances of different policies and find the coverage that aligns with your unique needs.

Get Multiple Quotes

To ensure you're getting the best deal, it's crucial to gather quotes from several different insurance companies. This not only helps you find the most competitive rates but also allows you to compare the coverage details and policy features side by side. Remember, the cheapest option may not always provide the most comprehensive protection, so take the time to thoroughly evaluate each quote.

Research Company Reputations

Before selecting an insurance provider, take the time to research their reputation and customer satisfaction ratings. Look for reviews from other drivers and consumer satisfaction surveys to gauge the insurer's track record for quality service and efficient claims handling. Choosing a reputable company can save you time and stress in the event of an accident.

By leveraging these strategies, you'll be well on your way to finding the car insurance coverage that checks all the boxes -- affordability, comprehensive protection, and exceptional service.

Unlocking Discounts for Young Drivers in Pennsylvania

As a young driver in Pennsylvania, you may be eligible for a variety of discounts that can significantly reduce your insurance premiums. Let's explore some of the most common ways to save.

Good Student Discounts

If you're a diligent student with a GPA of 3.0 or higher, you may qualify for good student discounts from many insurers. By maintaining strong academic performance, you can demonstrate your responsibility and potentially earn substantial savings on your car insurance.

Defensive Driving Course Discounts

Completing a defensive driving course not only enhances your skills behind the wheel but can also result in discounts from your insurance provider. These programs showcase your commitment to safe driving, which can translate to lower rates.

Multi-Car Discounts

If your family has multiple vehicles, consider insuring them under the same policy. Many insurance companies offer discounts for customers who bundle their cars, providing a cost-effective solution compared to separate policies.

Bundling Discounts

Speaking of bundling, you can also save by combining your car insurance with other types of coverage, such as renters or homeowners insurance. This can lead to lower overall premiums and streamline your insurance management.

Telematics Programs

Some insurers offer usage-based insurance programs that monitor your driving habits through a mobile app or device installed in your car. If you demonstrate safe driving behaviors, you may qualify for discounts -- a particularly appealing option for young drivers looking to prove their responsibility on the road.

By taking advantage of these discounts, you can maximize your savings and find car insurance that fits your budget without compromising on the coverage you need.

The Benefits of Sharing a Policy with Parents

As a young driver, one strategic option to consider is sharing a car insurance policy with your parents. This approach can offer significant advantages in terms of cost savings and access to additional discounts.

Cost Savings

By being added to your parent's existing policy, you can often benefit from lower premiums compared to having a standalone policy. Insurance companies generally offer more favorable rates for family policies, making this a financially savvy choice for new drivers.

Tapping into Parental Discounts

Your parents may already qualify for various discounts that can extend to you when you're included on their policy. This could include multi-car discounts, safe driver discounts, and bundling discounts, further enhancing the cost savings.

Considerations

While sharing a policy with your parents can be a smart financial move, it's essential to have an open discussion about the implications. Understand how adding you to their policy may impact their premium and whether higher deductibles might be necessary. Maintaining clear communication will ensure that everyone is on the same page regarding coverage and costs.

By exploring the option of sharing a car insurance policy with your parents, you can unlock significant savings while benefiting from their driving experience and existing discounts.

FQAs: Addressing Common Car Insurance Questions for Young Drivers in Pennsylvania

Q: How much is car insurance for a 16-year-old in Pennsylvania?

A: The cost of car insurance for a 16-year-old in Pennsylvania can vary widely depending on factors like driving record, the vehicle insured, location, and more. However, it's generally more expensive for young drivers compared to older, more experienced motorists.

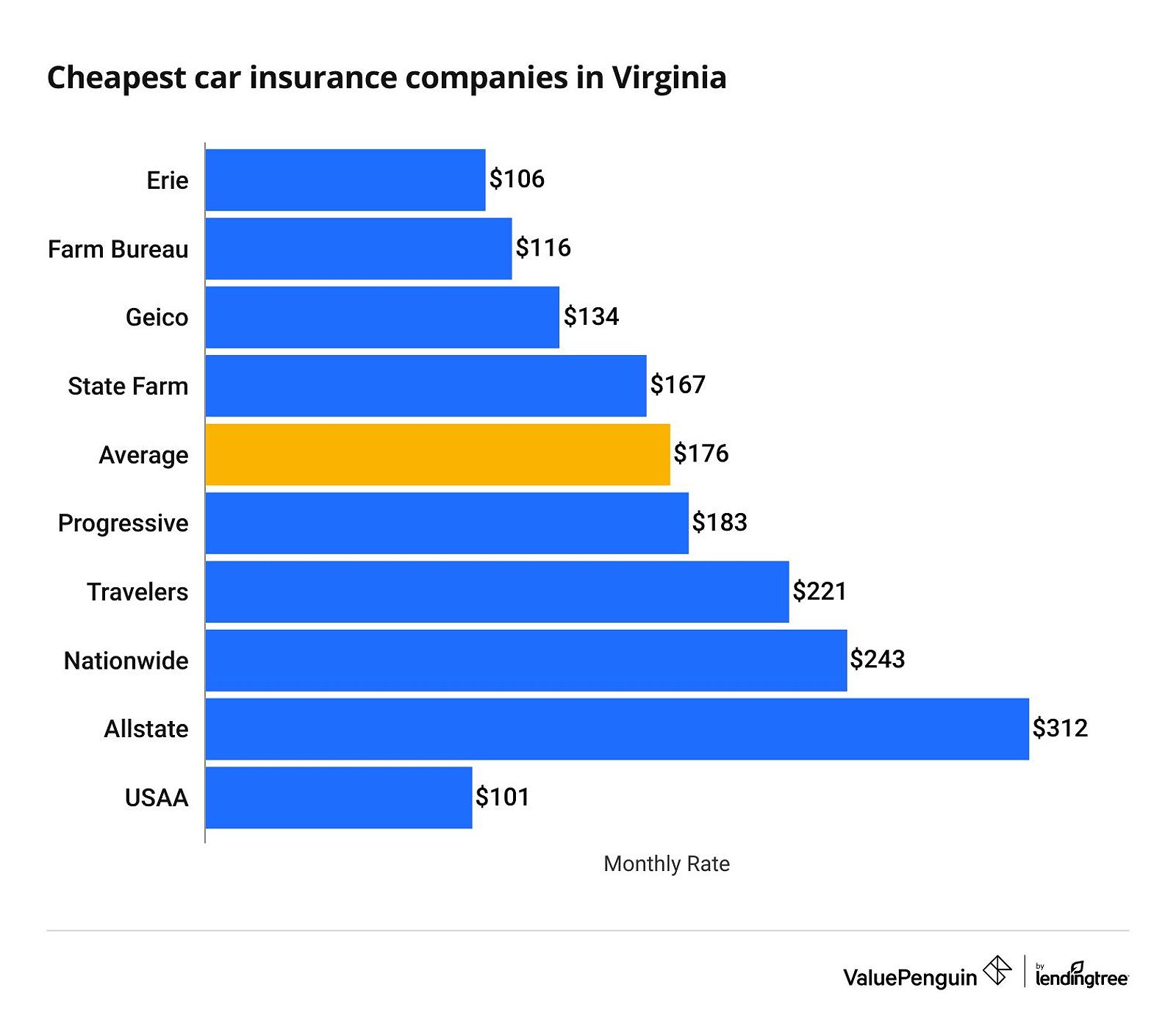

Q: What are the best car insurance companies for young drivers in Pennsylvania?

A: Some of the top car insurance companies in Pennsylvania that offer competitive rates and coverage for young drivers include Erie Insurance, State Farm, GEICO, and Nationwide. It's important to shop around and compare quotes from multiple providers to find the best fit.

Q: Can I get car insurance if I'm a student driver?

A: Yes, you can absolutely get car insurance as a student driver in Pennsylvania. However, you may need to provide proof of driving experience or complete a driver's education course to qualify for certain discounts and coverage options.

Conclusion: Empowering Young Drivers in Pennsylvania

As a young driver in Pennsylvania, the journey to finding the right car insurance can feel daunting, but with the right information and strategies, it doesn't have to be. By understanding the state's coverage requirements, familiarizing yourself with the key factors that influence rates, and leveraging available discounts, you can navigate the insurance landscape with confidence.

Remember, taking the time to research, compare quotes, and explore your options is the key to securing the most comprehensive and cost-effective car insurance coverage. With this knowledge in your back pocket, you'll be well on your way to hitting the open roads of Pennsylvania with the peace of mind that comes from knowing you're protected.

So, what are you waiting for? Start your car insurance quote journey today and take the first step toward driving with confidence, freedom, and financial responsibility. The open road awaits!