Car Insurance Quotes Dallas: Finding The Best Rates For New Drivers

As a fresh-faced driver in the bustling city of Dallas, the excitement of hitting the open road is often tinged with a hint of trepidation when it comes to the world of car insurance. With the ever-changing landscape of Texas regulations and a multitude of coverage options, the task of finding the right car insurance quotes can feel daunting. But fear not, my fellow Dallasites -- this comprehensive guide is here to equip you with the knowledge and tools to navigate this process with confidence. I remember when I first obtained my driver's license the thrill of independence was quickly tempered by the realization that I needed to secure proper coverage. Living in a city known for its unpredictable weather and congested streets, I understood that protecting myself and my vehicle was paramount. Through my own journey, I've learned the ins and outs of car insurance in Dallas, and I'm here to share these insights with you. This guide will help you understand the complexities of car insurance quotes Dallas and make informed decisions.

Understanding the Texas Car Insurance Landscape

In the Lone Star State, all drivers are legally required to carry a minimum level of liability insurance. This coverage serves as a financial safeguard, protecting you in the event of an accident where you are found responsible for damages or injuries to others. The Texas minimum liability insurance requirements are:

- $30,000 for bodily injury per person

- $60,000 for bodily injury per accident

- $25,000 for property damage per accident

While these figures represent the bare minimum, it's crucial to understand that this liability coverage only protects others involved in an accident -- it does not provide any protection for your own vehicle or personal injuries.

To truly safeguard yourself and your assets, I recommend exploring additional coverage options, such as:

- Collision Coverage: Pays for damage to your vehicle resulting from a collision, regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents, like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you're involved in an accident with a driver who lacks insurance or has insufficient coverage.

- Personal Injury Protection (PIP): Covers medical expenses and other costs, such as lost wages and funeral expenses, regardless of who is at fault.

By carefully selecting a combination of these coverages, you can create a comprehensive safety net to safeguard yourself and your vehicle on the roads of Dallas.

Unlocking Discounts for New Drivers

As a newcomer to the world of car insurance, you may be pleasantly surprised to discover that there are a variety of discounts available to help keep your premiums in check. Some of the most common discounts include:

Good Student Discount

Maintaining a strong academic record can earn you savings of up to 15% on your car insurance. Insurance providers often view good students as more responsible drivers, making them a lower-risk investment.

Defensive Driving Course Discount

Completing a state-approved defensive driving course can score you a discount of up to 10% on your policy. These courses equip you with valuable skills and safe driving techniques, demonstrating your commitment to being a cautious and attentive driver.

Multi-Car Discount

If you have more than one vehicle in your household, you may be eligible for a multi-car discount. By insuring all of your cars with the same provider, you can often achieve significant savings on your overall insurance costs.

Safe Driver Discount

Maintaining a clean driving record is one of the best ways to keep your car insurance premiums low. Many insurers offer discounts to drivers who have no accidents or moving violations on their record, which can be particularly beneficial for new drivers like yourself.

Comparing Car Insurance Quotes in Dallas

Now that you have a better understanding of the coverage options and available discounts, it's time to put this knowledge into action. Comparing car insurance quotes from multiple providers is the key to finding the most affordable and suitable policy for your needs.

I recommend starting your search by utilizing online comparison tools, which allow you to quickly gather and compare rates from a variety of insurance companies. This streamlined process enables you to input your personal information and vehicle details, then receive personalized quotes side-by-side.

In addition to online tools, consider reaching out to local insurance agents. They can provide you with customized quotes and may have access to discounts or coverage options that aren't readily available online. By combining the convenience of digital platforms with the personal touch of an agent, you can ensure you're making an informed decision.

As you review the quotes, pay close attention to the coverage limits, deductibles, and any available discounts. Avoid solely focusing on the lowest price, as that may come at the expense of adequate protection. Instead, seek a balance between affordability and comprehensive coverage that aligns with your unique needs as a new driver in Dallas.

Minimizing Your Insurance Costs

While finding the right car insurance quote is essential, there are additional strategies you can employ to keep your premiums as low as possible. Here are some tips to consider:

- Maintain a Clean Driving Record: Avoid tickets, accidents, and other infractions, as these can significantly impact your insurance rates. Establishing a positive driving history is one of the best ways to secure long-term savings.

- Choose a Safe Vehicle: When selecting a car, opt for models with high safety ratings. These vehicles are generally less expensive to insure, as they are perceived as lower-risk investments by insurance providers.

- Consider a Higher Deductible: Selecting a higher deductible can lower your monthly premiums, but be prepared to pay more out-of-pocket in the event of a claim. Ensure that the deductible amount is within your financial means.

- Bundle Your Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to additional savings. Many insurers offer discounts for bundling multiple coverage types.

- Review Your Policy Regularly: As your driving experience and needs evolve, revisit your insurance policy to ensure you're still getting the best value. Be proactive in adjusting your coverage as necessary to reflect changes in your circumstances.

FAQ

Q: How much car insurance should I get as a new driver?

A: At a minimum, you'll need to meet the Texas liability insurance requirements of $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage. However, I'd strongly recommend considering additional coverage options like collision, comprehensive, and personal injury protection to provide more comprehensive protection.

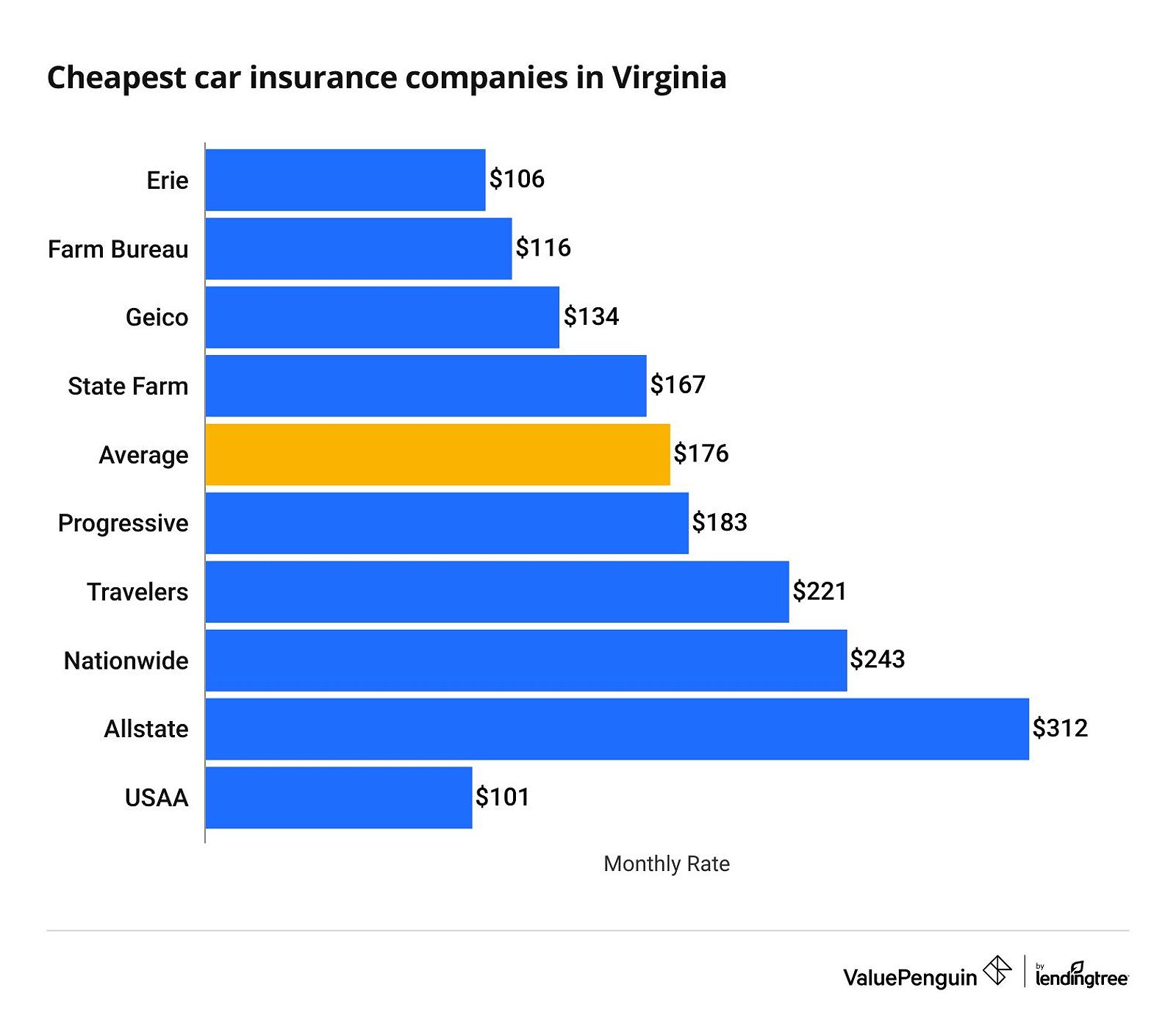

Q: What are some good car insurance companies for new drivers in Dallas?

A: Several well-known insurance providers have a reputation for offering competitive rates and excellent customer service for new drivers in Dallas. Some top contenders include Geico, State Farm, Allstate, and Progressive.

Q: How can I get a car insurance quote without affecting my credit score?

A: You can obtain car insurance quotes without impacting your credit score by using online comparison tools or reaching out to insurance agents directly. These quote requests are considered "soft" inquiries and won't appear on your credit report.

Q: What happens if I get a ticket or have an accident as a new driver?

A: If you receive a traffic ticket or are involved in an accident, your car insurance rates will likely increase. The extent of the increase will depend on the severity of the violation and your insurance provider's policies. Maintaining a clean driving record is crucial to keep your premiums as low as possible.

Conclusion

As a new driver navigating the bustling streets of Dallas, securing affordable and comprehensive car insurance coverage is a crucial step towards your journey of independence. By understanding the Texas insurance requirements, exploring available discounts, and comparing quotes from multiple providers, you can find the right policy to protect yourself and your vehicle.

Remember, the road ahead may have its challenges, but with the right knowledge and strategies, you can confidently manage your car insurance costs and focus on the thrill of driving. Embrace this newfound freedom, drive safely, and let this guide be your companion as you embark on the next chapter of your driving adventures in Dallas.

Whether you're a recent graduate, a young professional, or just starting your adult life, finding the perfect car insurance solution in Dallas is within your reach. By leveraging the insights and tips provided in this comprehensive guide, you can navigate the insurance landscape with confidence, ensuring that you're protected on the roads while keeping your hard-earned dollars where they belong -- in your pocket.

So, buckle up, and let's set out on this exciting journey together. With the right coverage and a strategic approach, you can conquer the streets of Dallas, embrace your newfound independence, and enjoy the open road ahead. The future is yours to explore, and with the proper insurance protection, the possibilities are endless.