Protecting Your Financial Future: Securing Inexpensive Workers' Compensation Insurance As A Self-employed Professional

As a self-employed individual, I know the endless hustle and bustle that comes with running my own business. From juggling client projects to keeping a close eye on expenses, it often feels like there's never a dull moment. However, amidst the chaos, one crucial aspect often gets overlooked: inexpensive workers' compensation insurance. Many self-employed professionals like myself assume that because we work alone, we're somehow immune to workplace injuries or illnesses. But the reality is that accidents can happen when we least expect them, and the financial fallout from unexpected medical bills can be truly staggering. Fortunately, securing affordable workers' compensation coverage is not only feasible but essential for protecting both my health and the long-term stability of my business. In this article, I'll share my personal insights and practical strategies for navigating the world of workers' compensation as a self-employed individual. Whether you're a freelance graphic designer, a self-employed electrician, or a solo entrepreneur in any other industry, you'll discover the invaluable benefits of this coverage, understand the state-specific requirements, and learn how to find the right policy that fits your budget without compromising your protection.

The Unparalleled Advantages of Workers Compensation for the Self-Employed

As someone who has experienced the challenges of running a self-employed venture, I can attest to the immense value that workers' compensation insurance brings to the table. When an unexpected injury or illness strikes, this coverage can be a true game-changer, providing the financial security and peace of mind that allow me to focus on my recovery without worrying about mounting medical bills or lost income.

Take, for example, the case of a freelance graphic designer like myself who develops severe carpal tunnel syndrome from hours spent hunched over a computer. Without workers' comp, the cost of physical therapy and lost billable hours could quickly add up, threatening the financial stability of my business. But with the right policy in place, I can rest assured that my medical expenses will be covered, and I'll receive a portion of my lost income while I focus on my recovery.

Similarly, as a self-employed electrician, I know that the risk of sustaining a serious injury while working on a client's electrical system is ever-present. Workers' compensation insurance would provide the coverage I need to access emergency medical care, ongoing treatment, and even vocational rehabilitation to ensure a safe and successful return to work.

By investing in this essential coverage, I'm not only safeguarding my financial wellbeing but also providing myself with the peace of mind to concentrate on my work and the growth of my self-employed venture. Knowing that I'm protected in the event of an unexpected accident or illness allows me to approach each project with confidence and focus, secure in the knowledge that my business is shielded from the potentially crippling costs of a work-related incident.

Navigating the State-Specific Landscape of Workers Compensation

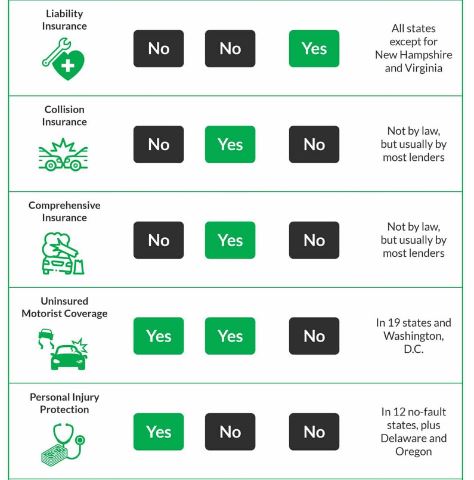

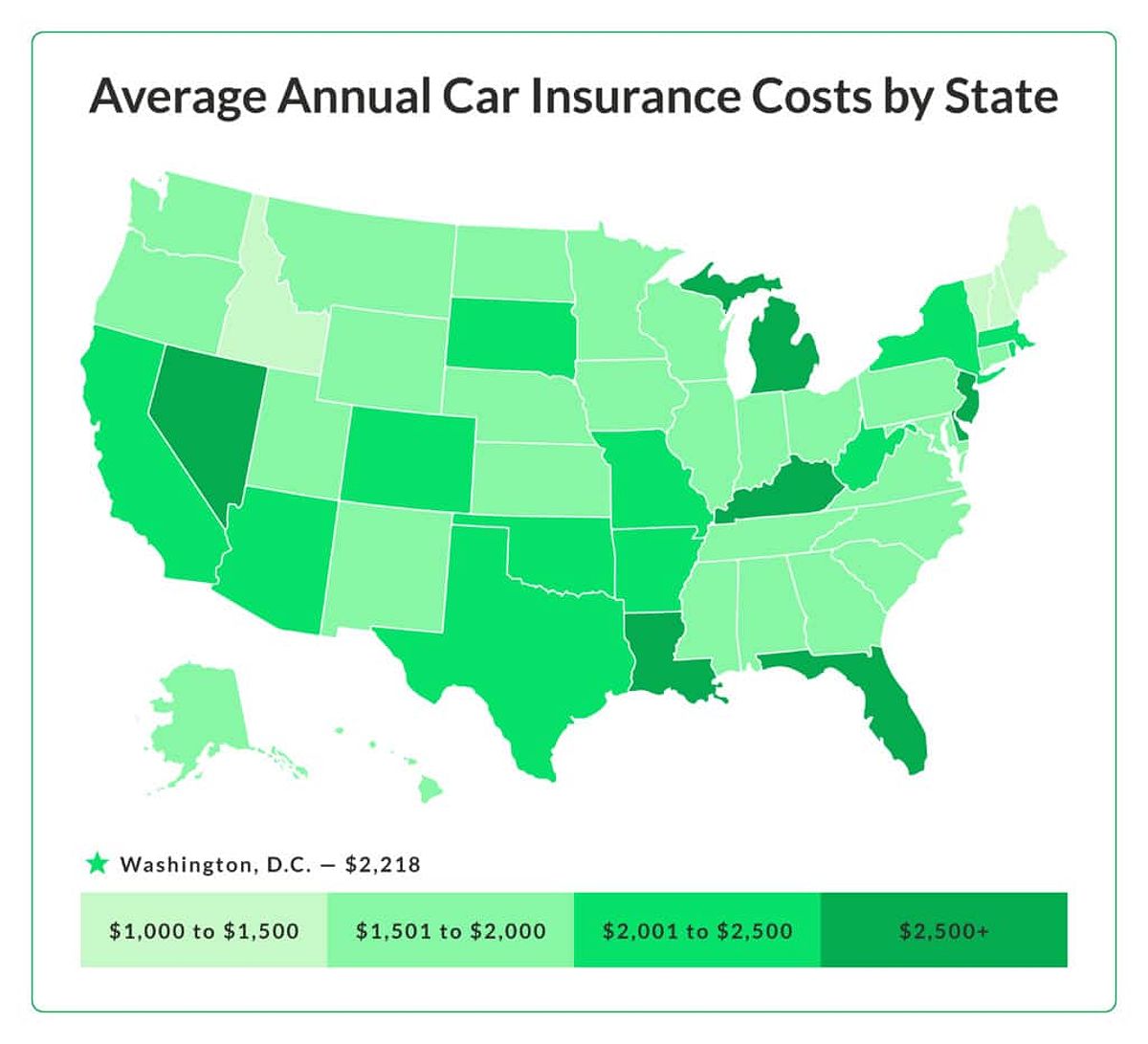

As a self-employed professional, it's crucial to understand the specific workers' compensation requirements in my state. The laws and regulations surrounding this coverage can vary significantly across the United States, and failing to comply can result in hefty fines and penalties.

For instance, in my home state of California, I'm required to carry workers' compensation insurance, regardless of whether I have any employees or not. This is a common scenario in many states, where self-employed individuals are mandated to have this coverage. On the other hand, there are states like Texas and South Dakota that do not have a universal requirement for workers' comp, though it's still a wise investment for self-employed individuals like myself.

Familiarizing myself with the regulations in my state has been essential in ensuring that I'm providing the necessary protection for my business. Some states, like Florida, even require proof of workers' compensation coverage for certain licenses or certifications, so it's crucial that I stay up-to-date on the latest requirements.

While there are some states that offer exemptions for sole proprietors or independent contractors, I've learned that it's essential to weigh the potential risks carefully before opting out of coverage. The financial strain of an unexpected work-related injury or illness could be overwhelming, and the lack of coverage could jeopardize the long-term viability of my self-employed venture.

Securing Inexpensive Workers Compensation Insurance: A Seamless Process

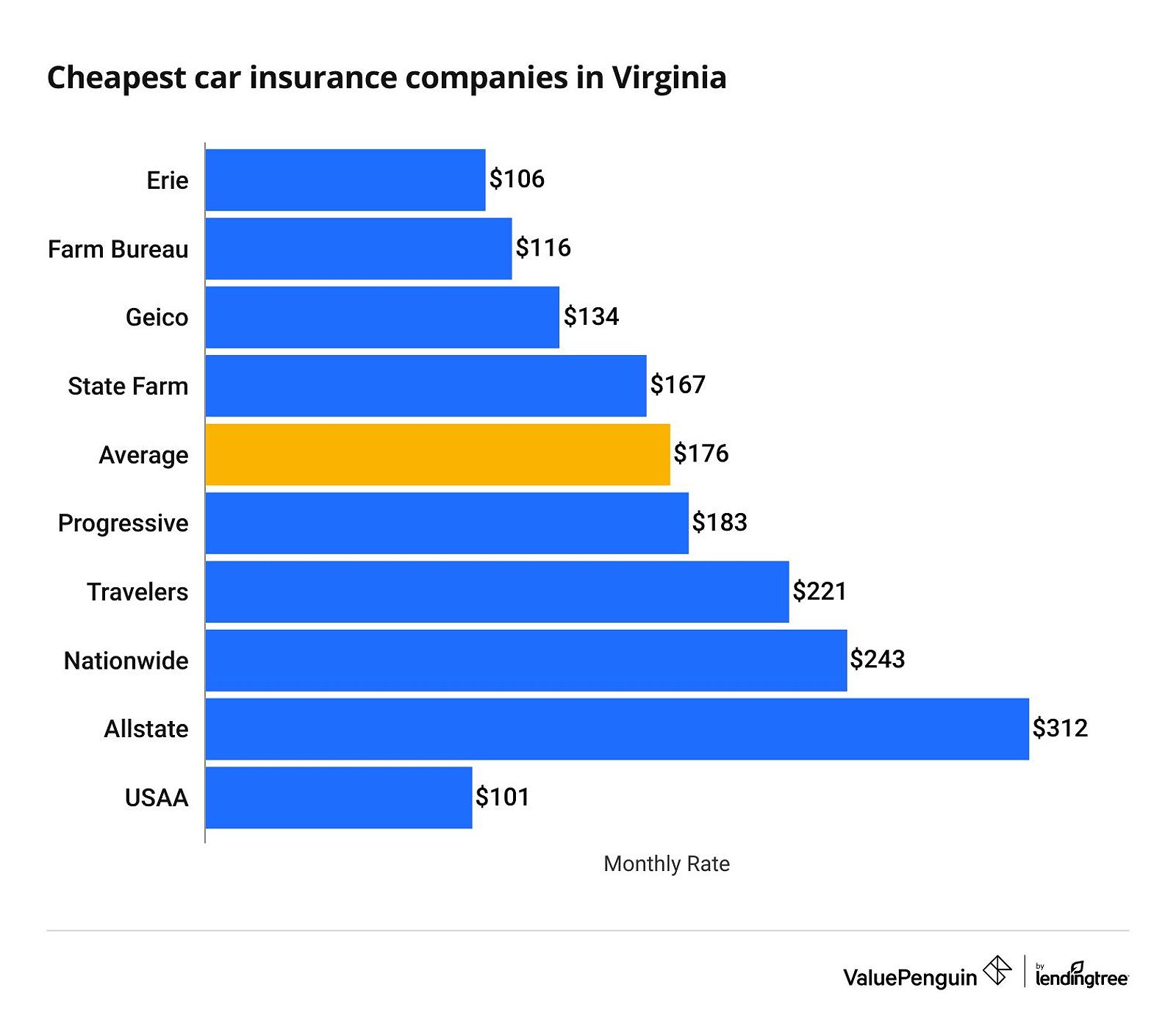

As a self-employed professional, I'll admit that the prospect of navigating the world of workers' compensation insurance can seem daunting at first. However, with a bit of research and planning, I've been able to find affordable options that provide the coverage I need without breaking the bank.

One of the key strategies I've employed is to shop around and compare quotes from multiple insurance providers. By leveraging online tools and resources, I can quickly and easily compare the offerings of different companies, ensuring that I'm getting the best deal possible. Additionally, I've discovered that many insurers who specialize in serving self-employed individuals often provide more tailored coverage at competitive rates.

Another approach I've found effective is to consider bundling my workers' compensation policy with other insurance products, such as general liability or property insurance. Many providers offer discounts for bundled policies, which can lead to significant savings. I've also made it a point to inquire about any available discounts, whether it's for safety training, a strong safety record, or other factors that demonstrate my commitment to risk management.

Perhaps one of the most valuable lessons I've learned is the importance of regularly reviewing my workers' compensation coverage. As my business evolves and my needs change, I make it a point to revisit my policy to ensure that it still meets my requirements and remains cost-effective. This proactive approach has allowed me to make informed decisions and maintain the right level of protection for my self-employed venture.

Prioritizing Safety: The Key to Minimizing Costs

As a self-employed individual, I understand that the responsibility for maintaining a safe work environment ultimately rests on my shoulders. By taking proactive steps to reduce the likelihood of work-related injuries and illnesses, I can not only protect myself and my business but also keep my workers' compensation insurance costs down in the long run.

One of the first things I've done is to implement robust safety protocols in my work environment. This includes using the proper equipment, maintaining a clean and organized workspace, and educating myself on potential hazards in my industry. I've also invested in ergonomic solutions, such as an adjustable desk and ergonomic chair, to prevent repetitive strain injuries.

Establishing a culture of safety within my business has been a game-changer. By encouraging open communication about safety concerns and regularly reviewing and updating my safety practices, I've been able to demonstrate to my insurance provider that I'm a responsible and diligent business owner. This, in turn, has led to lower premiums and the peace of mind that comes with knowing I'm protecting myself, my finances, and the long-term success of my self-employed venture.

FQAs

Q: Do I need workers' compensation insurance if I'm a sole proprietor?

A: The answer to this question depends on the laws in your state. Some states require all self-employed individuals, including sole proprietors, to carry workers' compensation coverage, while others offer exemptions. It's essential to check with your state's workers' compensation agency to understand the specific requirements.

Q: How much does workers' compensation insurance typically cost for self-employed individuals?

A: The cost of workers' compensation insurance for self-employed individuals can vary greatly depending on factors such as your industry, location, and the level of coverage you choose. However, I've found that it's often more affordable than you might think, especially if you shop around and compare quotes from multiple providers.

Q: What if I get injured while working from home?

A: Even if you work from a home office, you can still sustain work-related injuries. Workers' compensation insurance can provide coverage for these types of incidents, helping to pay for medical expenses and lost income during your recovery.

Q: What are some common exclusions in workers' compensation policies?

A: Exclusions can vary by policy, but they often include injuries that occur while you're not working, injuries caused by intentional acts, or injuries sustained due to intoxication. It's crucial to review the policy details carefully to understand what is and isn't covered.

Conclusion: Safeguarding Your Financial Future with Inexpensive Workers Compensation Insurance

As a self-employed professional, protecting the health and financial well-being of my business is a top priority. By investing in inexpensive workers' compensation insurance, I've been able to safeguard my future and approach my work with the confidence and peace of mind that come from knowing I'm covered in the event of an unexpected accident or illness.

Whether you're a freelance graphic designer, a self-employed electrician, or a solo entrepreneur in any other industry, securing the right workers' compensation policy can be a game-changer. By understanding the state-specific requirements, exploring cost-effective coverage options, and proactively managing workplace risks, you can find the protection you need without sacrificing your financial security.

Remember, inexpensive workers' compensation insurance is not just about compliance; it's about ensuring the long-term stability and growth of your self-employed venture. Take the time to explore your options, compare quotes, and make an informed decision that supports your business and provides the financial security you deserve. With the right coverage in place, you can focus on what you do best: growing your self-employed business and achieving your entrepreneurial dreams.