Finding The Best Car Insurance In Utah For Young Drivers: Coverage That Fits Your Budget

As a young driver navigating the roads of Utah, the search for affordable car insurance can feel like a daunting task. With the high costs associated with insuring inexperienced motorists, it's easy to assume that finding coverage within your budget is virtually impossible. However, the reality is quite different. By understanding the market, exploring your options, and leveraging the right strategies, you can secure excellent protection for your vehicle and your finances. In this comprehensive guide, I'll take you on a journey to uncover the best car insurance in Utah tailored specifically for young drivers like yourself. We'll dive deep into the state's requirements, analyze the top providers, and equip you with the knowledge and tools to make informed decisions. Get ready to drive with confidence, knowing you've found the perfect balance between coverage and cost.

Navigating Utah's Car Insurance Landscape for Young Drivers

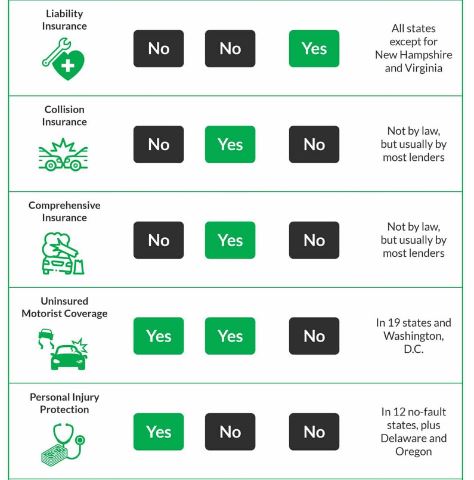

In the Beehive State, all drivers, including those just starting their driving journeys, are required to carry a minimum level of car insurance. This includes:

Mandatory Liability Coverage

- Bodily Injury Liability: This coverage is crucial, as it pays for the medical expenses of others if you're involved in an accident. The minimum requirement in Utah is $25,000 per person and $65,000 per accident.

- Property Damage Liability: This aspect of coverage ensures that damages you cause to another person's property, such as their vehicle or a fence, are taken care of. The minimum required amount in Utah is $15,000 per accident.

Understanding these core requirements is essential to avoid legal and financial consequences. Additionally, Utah is a no-fault state, meaning you must also carry personal injury protection (PIP) coverage of at least $3,000 per person. This safeguards you and your passengers in the event of an accident, regardless of who is at fault.

While the state minimums provide a solid foundation, young drivers may want to consider adding additional coverages, such as collision and comprehensive, to fully protect their vehicle and financial well-being.

Supplementary Coverage Options

- Collision Coverage: This type of insurance helps pay for damages to your own vehicle resulting from a collision, regardless of who is at fault. If you're financing your car, your lender may require this coverage.

- Comprehensive Coverage: This protects your vehicle from non-collision-related damages, such as theft, vandalism, or natural disasters. It's often a wise choice for new or expensive vehicles.

- Uninsured/Underinsured Motorist Coverage: Given the significant number of underinsured drivers in Utah, this coverage is particularly important. It safeguards you in the event of an accident with someone who lacks adequate insurance.

By understanding the mandatory requirements and exploring these supplementary options, you can build a well-rounded car insurance policy that provides the protection you need without breaking the bank.

Identifying the Cheapest Car Insurance Providers for Young Drivers in Utah

When it comes to finding the most affordable car insurance options as a young driver in Utah, a few key providers stand out:

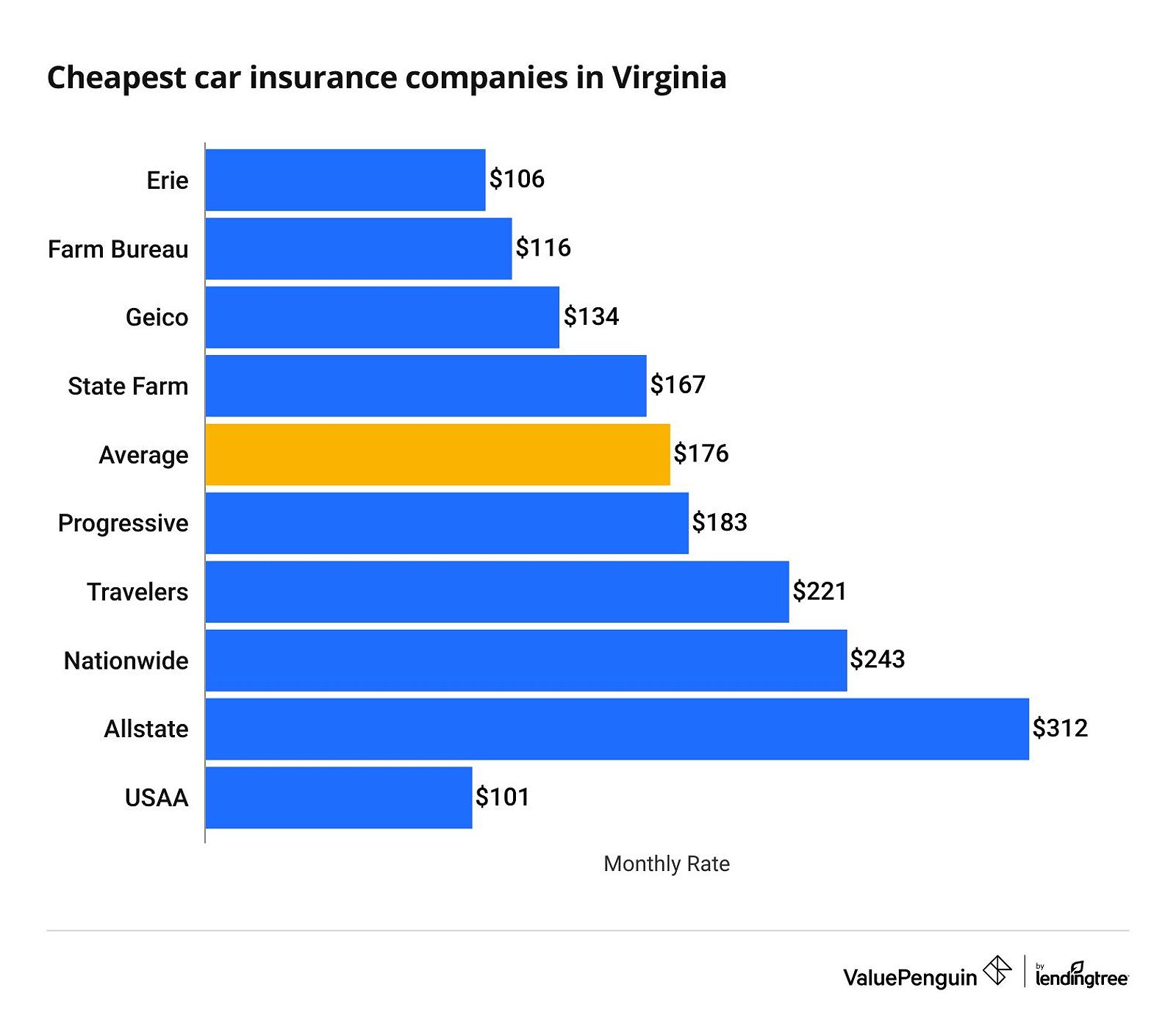

Nationwide: A Reliable Choice for Budget-Conscious Drivers

Nationwide is known for offering some of the most competitive rates for young drivers in Utah, particularly when it comes to minimum liability coverage. The company's discounts and programs specifically designed for young motorists, such as good student discounts and driver training initiatives, can significantly reduce your premiums.

According to our research, a 16-year-old driver in Utah can expect to pay an average of $5,038 per year for a full-coverage policy with Nationwide, while a 21-year-old driver could pay around $2,115 annually. With Nationwide's commitment to providing affordable coverage, you can rest assured that you're getting the protection you need without sacrificing your financial well-being.

Geico: Leveraging Innovative Discounts for Young Drivers

Geico is another top choice for young drivers in Utah, often providing the most affordable full-coverage policies. The company's telematics programs, which monitor driving behavior and reward safe habits with discounts, can be particularly beneficial for young, inexperienced drivers.

Our data shows that a 19-year-old driver in Utah can find full-coverage policies with Geico for an average of $2,844 per year, while a 25-year-old driver could pay around $1,644 annually. Geico's user-friendly mobile app also allows you to manage your policy and file claims with ease, further enhancing the overall experience.

USAA: A Tailored Option for Military Families

For young drivers with a military connection, USAA is an excellent option for affordable car insurance in Utah. While USAA's coverage is only available to active-duty military members, veterans, and their families, the company's rates and discounts can make a significant difference in your insurance costs.

On average, a 17-year-old driver in Utah can expect to pay around $5,143 per year for a full-coverage policy with USAA, while a 21-year-old driver could pay approximately $2,504 annually. USAA is renowned for its exceptional customer service and offers various discounts, including for safe driving and bundling policies, which can help lower costs for young drivers.

Strategies to Maximize Savings on Car Insurance as a Young Driver in Utah

As a young driver in Utah, there are several strategies you can employ to lower your car insurance premiums and secure the best coverage for your needs:

Shop Around and Compare Quotes

The key to finding the most affordable car insurance rates is to shop around and compare quotes from multiple providers. Utilize online resources, such as insurance comparison websites, to easily obtain and compare quotes from various companies. Don't settle for the first quote you receive; take the time to explore different options, as rates can vary significantly from one insurer to another.

Take Advantage of Discounts

Young drivers in Utah can often qualify for a variety of discounts, including good student discounts, safe driver discounts, and multi-car discounts. Be sure to ask your insurance agent about the available discounts and ensure you're taking advantage of every opportunity to save. For instance, if you have completed a driver education course or have a clean driving record, many insurers will offer lower rates.

Maintain a Spotless Driving Record

One of the most effective ways for young drivers to keep their car insurance rates low is to maintain a clean driving record. Avoid traffic violations, accidents, and other infractions that can significantly increase your premiums. Many insurance companies closely monitor your driving behavior, and a spotless record can lead to additional discounts over time.

Consider Usage-Based Insurance

Some insurance companies offer usage-based insurance programs that track your driving habits through a mobile app or device installed in your vehicle. If you are a safe driver, you may qualify for significant discounts based on your driving behavior. This option can be particularly advantageous for young drivers who may not drive frequently or who exhibit safe driving practices.

By employing these strategies and staying proactive in your search for the best car insurance in Utah, you can navigate the market with confidence and find the coverage that fits your budget and needs.

Additional Factors to Consider for Young Drivers in Utah

As you explore car insurance options in Utah, there are a few additional factors that can impact your rates:

Your Vehicle's Make and Model

The type of vehicle you drive can have a significant influence on your car insurance premiums. Generally, sports cars and luxury vehicles tend to have higher insurance costs, while more practical, family-friendly models may be more affordable to insure. When shopping for a new car, consider how the make and model will affect your insurance expenses.

Your Credit Score

In Utah, your credit score can also play a role in determining your car insurance rates. Maintaining a good credit score can help you secure lower premiums, so it's essential to monitor and improve your financial health over time. Many insurers use credit scores as a factor in their pricing, so taking steps to enhance your credit can benefit you in multiple ways.

Safety Features on Your Vehicle

Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and collision avoidance systems, can qualify for discounts. When exploring your options, prioritize models that offer these features, as they not only enhance your safety but can also lower your insurance costs.

By considering these additional factors, you can further optimize your car insurance strategy and ensure you're getting the best possible coverage at a price that fits your budget as a young driver in Utah.

FAQ

Q: How can I get a car insurance quote in Utah?

A: Obtaining car insurance quotes in Utah is a straightforward process. You can visit insurance company websites, use online quote comparison tools, or reach out to local insurance agents to get personalized quotes tailored to your needs.

Q: What are the penalties for driving without car insurance in Utah?

A: Driving without the minimum required car insurance in Utah can result in serious penalties, including fines, license suspension, and vehicle registration issues. It's crucial to ensure you have the appropriate coverage to avoid these consequences and maintain legal compliance.

Q: What are some ways to lower my car insurance premiums after an accident or violation?

A: If you've had an accident or violation on your driving record, there are a few strategies you can employ to help lower your car insurance premiums. These include taking defensive driving courses, exploring accident forgiveness programs, and waiting for your record to improve over time.

Q: Are there specific insurance options for high-risk drivers in Utah?

A: Yes, high-risk drivers in Utah can explore options like SR-22 insurance, which is a certificate of financial responsibility required for certain violations. While rates may be higher, some companies specialize in high-risk insurance and may offer competitive coverage options.

Conclusion: Securing the Best Car Insurance in Utah for Young Drivers

As a young driver navigating the roads of Utah, finding affordable car insurance doesn't have to be a daunting task. By understanding the state's requirements, exploring the top providers like Nationwide, Geico, and USAA, and leveraging the right strategies, you can secure the coverage you need at a price that fits your budget.

Remember, maintaining a clean driving record, taking advantage of available discounts, and considering your vehicle's make, model, and safety features can all contribute to lowering your insurance costs. With the right approach, you can drive with confidence, knowing you've found the perfect balance between comprehensive protection and financial responsibility.

Embark on your journey to find the best car insurance in Utah for young drivers today. Utilize the resources and insights provided in this guide to make informed decisions and secure the coverage that will safeguard you and your vehicle. Happy driving!